Introduction

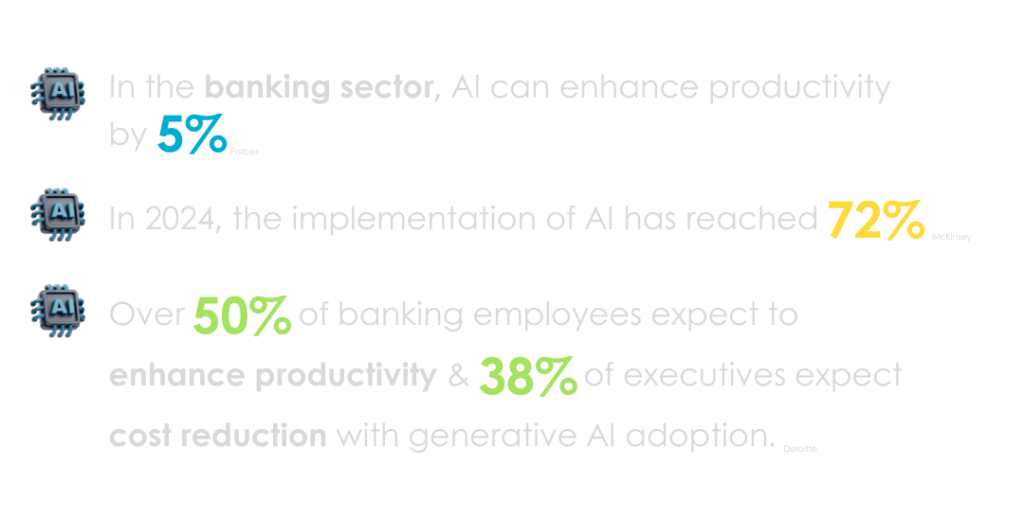

With businesses operating globally, organizations are under continuous pressure to maintain sustainability, efficiency, and customer satisfaction and minimize operating costs. Financial institutions also have similar challenges. The banking, financial services, and insurance (BFSI) industry attracts various regulations and guidelines. To reduce operating costs, it is significant for the organization to explore and implement innovative strategies. Automation and optimization are two of those effective strategies.

In this blog, we’ll explore the understanding of optimization and automation and learn about the results associated with the implementation of these strategies. This blog also includes the impact of these strategies on the BFSI sector globally.

Optimization: The First Step

Optimization includes implementing a system to help manage workflow and enhance efficiency. It is a process of finding weak points, evaluating operations, and modifying strategies to enhance overall performance and minimize costs.

How Optimization Helps BFSI in Cost Reduction?

Optimization is an essential strategy that adopted by businesses to enhance efficiency and reduce operational costs. We’ve listed some of the best ways optimization assists BFSI organizations in reducing costs:

- Data-Driven Decision Making: Financial institutions handle numerous customers that generate huge amounts of data. With optimization, such institutes and related companies can use data analytics and make data-driven decisions to ensure profitability and cost reduction.

- Workforce Optimization: Business operations rely heavily on the workforce, and hiring specialized individuals attracts huge costs. Workforce optimization tools are used by businesses to ensure optimum utilization of resources and manage workloads.

- Enhance Operational Process: The BFSI industry deals with various complexities that involve managing accounts to approving loans. Optimization helps streamline the BFSI processes by implementing digital tools and other related approaches, ultimately reducing operational costs.

Automation: The Second Step

Automation is a technological upgrade that is used by the company to automate processes and systems with or without little involvement of human resources. Automation aims to minimize repetitive tasks, eliminate errors, and enhance productivity. AI-based tools, robotics, and advanced software are some of the examples of automated technology.

How Does Automation Help BFSI in Cost Reduction?

Digitalization has transformed the business world with new technologies and tools. One of such technologies is automation. The implementation of automation results in eliminating labor-intensive processes, enhancing mistakes, and promoting accuracy. Here we list down the ways how automation assists in cost reductions:

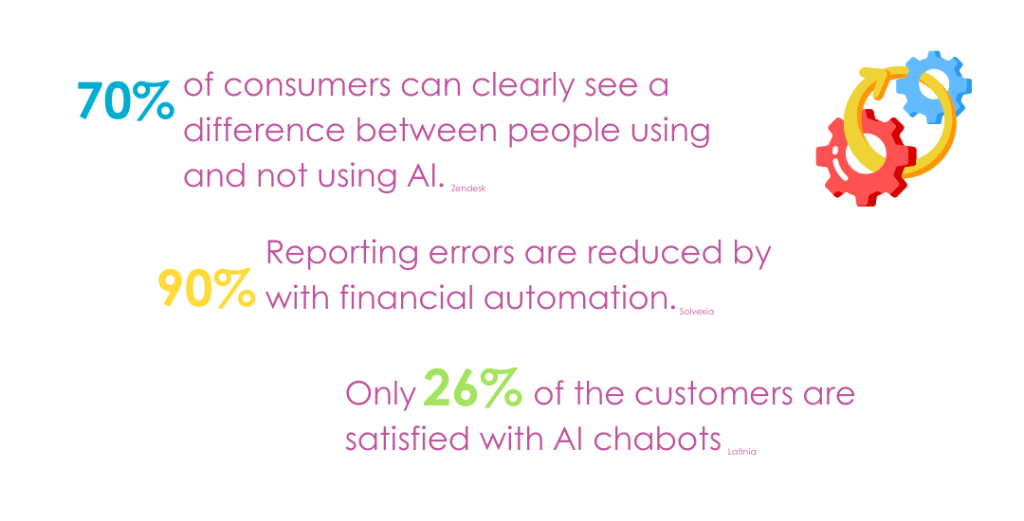

- AI and Chatbots: Customer services are a huge part of BFSI businesses and attract a significant amount of cost. Organizations are using chatbots and virtual assistants (VAs) to handle day-to-day operations, including customer inquiries, ultimately reducing the involvement of agents. This aims to reduce the cost significantly.

- Automated Risk and Compliance Management: BFSI companies operate globally and require compliance with several rules and regulations. Compliance and associated risks can lead to large penalties and monetary fines. With automation, companies can evaluate the regulatory data and ensure compliance with applicable laws. This minimizes the chances of monetary penalties and defamatory impacts on the business.

- Robotic Process Automation (RPA): Similar to AI and VA, RPA uses bots backed by different software to complete monotonous operations, freeing up human resources. This minimizes the employees’ efforts significantly, ultimately leading to cost reduction.

- Digital Transactions: The business world has transformed from paper-based transactions to digital transactions. This shift has led to organizations adopting digital technologies for making payments and other operational dealings. BFSI institutes also use digital transactions to minimize their costs.

The Impact of Optimization and Automation on the Global BFSI Sector

BFSI institutes benefit from the adoption of these technologies while operating globally. These benefits are:

- Improved Customer Experience: Optimized and automated tools minimize agents’ efforts, automating repetitive tasks. This leads to BFSI organizations achieving efficiency with optimum utilization of resources.

- Business Growth: Optimization and automation allow BFSI institutes to promote their operations and enter new markets efficiently. This saves the organizations’ funds and supports their growth internationally.

- Greater Compliance: Automated and optimized tools ensure compliance with internationally applicable laws. It reduces the chances of legal penalties and fines.

- Enhanced Operational Proficiency: Automation and optimization use AI-based tools to deal with customers’ queries quickly with enhanced personalized services.

The Future of Cost Reduction in BFSI

With new technologies being developed regularly, BFSI businesses seek the adoption of optimization and automation for sustainable growth. There are various technologies that will be used by BFSI and are as follows:

- Hyper Automation: The incorporation of AI, VA, and RPA can automate the overall process, ultimately enhancing productivity and saving costs.

- Blockchain Transactions: These transactions are backed by a blockchain network with extensive security to safeguard digital transactions.

- AI-based Predictive Analytics: Such technologies use datasets to predict market trends and patterns to make informed decisions.

Conclusion

Automation and optimization are some of the technologies which are compulsory for the BFSI sectors. To streamline operational processes and systems, it is essential for the BFSI organizations to integrate technologies like AI, VA, and RPA and promote digital transformation. With such implementation, financial institutes can minimize operational costs while improving productivity and customer experiences.

In this competitive business world, BFSI organizations can become global leaders with the implementation of optimization and automation.