When it comes to compliance management, it is significant that applicable standards and regulations are met. Similarly, insurance companies must make sure that every agent follows rigorous standards. It includes recording customers’ interactions, securing established channels, and adhering to approved scripts. Non-compliance can lead to reputational damages, penalties, and lawsuits.

This blog includes understanding compliance management, its significance, and its challenges. This blog also explores the best compliance management strategies for insurance call centers. It also drives the factors involved in the transformation of insurance call center operations with NEQQO.

1. Understanding Compliance Management

1.1. What is Compliance Management?

The high-stakes atmosphere of the insurance industry attracts a huge pile of customer data (financial and personal data). Insurance call centers must follow the established and applicable regulations that are governed by various regulatory bodies. Moreover, the insurance call centers must make sure that every customer-agent interaction is fair and attracts no violations.

Insights:

According to “80+ Customer Service Statistics You Need to Know in 2025“, AmpliAi, 61% of the agents state that their quality assurance measures compliance–related issues.

As per a “Survey: Only 16% of Organizations are Approaching the Next Frontier of Compliance,” FloQast, only 16% of the companies are ready to adopt effective strategies for compliance management.

80% of the professionals focus on finding out the compliance risks and providing assistance to the organizations.

2. Significance of Compliance Management

For insurance call centers to be successful, it is essential that the leadership has established a structured plan to meet the industry’s norms and regulations. The key aspects of compliance management are as follows:

- Regulatory Requirements: As we know, the highly regulated insurance world requires compliance with various regulations. The insurance call centers follow the Gramm-Leach-Bliley Act (GLBA), the Health Insurance Portability and Accountability Act (HIPAA), the Telephone Consumer Protection Act (TCPA), and more. Compliance management ensures that such norms and regulations are adhered to effectively.

- Data Security: It is essential that advanced security protocols are established to safeguard customers’ sensitive data. This also includes call encryptions and access controls to further prevent data breaches. Compliance management promotes security and data protection, ultimately improving customers’ trust and brand value.

- Ethical Environment: Insurance call centers are surrounded by regulatory authorities or bodies attracting several regulations. Therefore, establishing a compliance culture is necessary to promote an ethical working environment. This encourages the agents to work within the established ethical standards, thus improving job satisfaction and minimizing non-compliance.

- Competitive Edge: Companies that are committed to complying with the norms have competitive advantages. Such commitment builds customers and clients trust, making it a decisive factor to choose amongst different players in the industry.

- Enhanced Productivity: Compliance management provides operational clarity to the agents as well as leadership, ultimately improving productivity and performance.

- Risk Reduction: Non-compliance promotes financial losses and operational inefficiencies. With compliance management, regulatory risks can be identified and managed easily. Effective compliance strategies allow the call centers to identify the issues and resolve them before they escalate.

3. Challenges of Compliance Management

As we’ve learned, compliance management has high significance in insurance call centers; however, organizations face various challenges while implementing compliance management. These challenges are:

- Data Breach: Customer data includes sensitive information, involving personal and financial details. With the rise in customers, the customer data also piles up. This makes it vulnerable to security breaches.

- Quality Monitoring (QM): QM is considered the foundation of compliance management. Insurance call centers record customer data and calls, which can be monitored for quality checks. However, keeping track of default calls becomes difficult.

- Script Adherence: In customer support services, agents are required to follow an approved script. Going off the approved scripts can lead to non-compliance, ultimately attracting violations and penalties.

- Evolving Regulatory Updates: The insurance world revolves around various regulations; however, such guidelines or norms are continuously amended. Staying updated with the amendments is necessary to avoid legal consequences.

Insights

92% of call center agents confirms that their company is using quality assurance program.

83% of CX leaders confirm that data protection and cyber security are their top priority.

4. How to Ensure Compliance in Insurance Call Center Operations

The industry demands the implementation of proactive approaches to cover every side of insurance call center operations. We’ve listed several strategies that a leader can adopt to ensure compliance:

- Technological Advancement: The business world is disrupted by the advanced technologies that promote operational efficiency and transparency. Insurance call centers must adopt digital platforms like NEQQO that embed compliance directly with the call center’s operations. Such technologies also enhance security, effective quality monitoring, and generate comprehensive reports. Ultimately, the implementation of technology enhances overall compliance.

”76% of call centers are scheduling to adopt automation and AI.”

- Empower Supervisors: Supervisors hold a significant role in establishing a compliance culture. One of their roles is call monitoring; therefore, the supervisor can also intervene when an issue arises. Supervisors must have the authority to provide on-the-spot coaching to eliminate the chances of non-compliance and promote high-standard practices.

- Data Insights and Continuous Improvement: Insurance call centers have to deal with extensive data collection. However, such customer data can be used by companies to generate informative insights. This helps the call centers to generate improved guidelines and training programs for the agents and ensure compliance with the applicable regulations.

- Transparent and Accountable Working Environment: To develop customer trust and loyalty, it is significant for call center agents to stay committed to accountability and transparency. This can be done by ensuring that agents stick to approved practices and compliance standards. Moreover, such a working environment leads to the creation of a responsible team and ensures compliance.

5. How NEQQO Secures Compliance

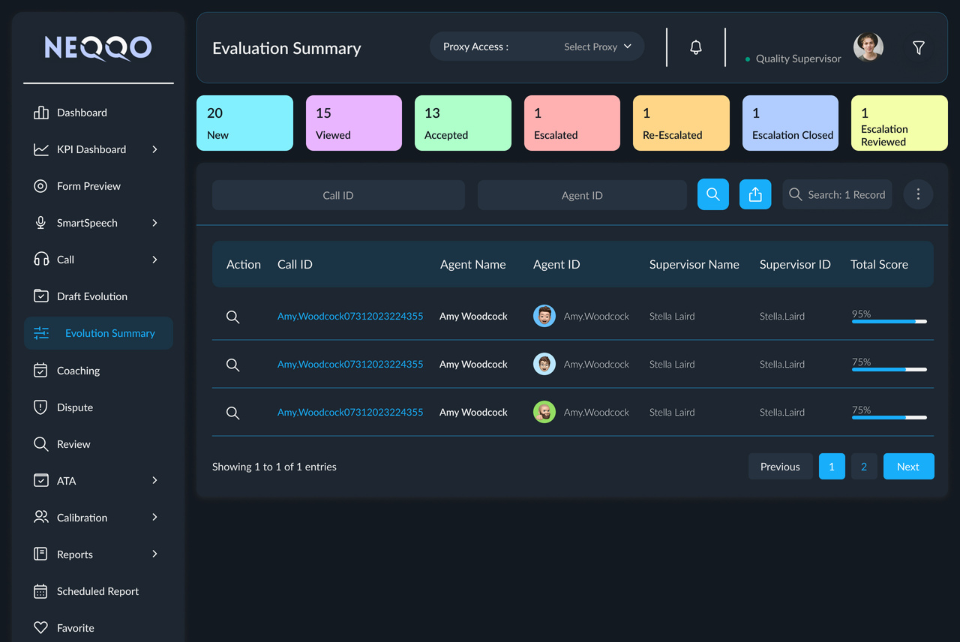

NEQQO is a modern solution that provides the right tools for quality management, compliance management, and advanced reporting. This platform monitors recordings and identifies non-compliance with ethical standards. The auto-detection feature alerts supervisors about conflicts, guides them to take appropriate actions, and avoids disputes.

“NEQQO improved the compliance adherence by 20%.”

5.1. Key Features That Drive Compliance

- End-to-End Monitoring: NEQQO evaluates every call to generate effective insights. Such oversight ensures compliance with industry standards.

- AI-Based Tools: NEQQO delivers quick and AI-generated call summaries, providing key points and actionable items. These summaries promote swift monitoring, ensuring that the information related to compliance is recorded accurately.

- Manual Evaluation: Apart from having AI tools, NEQQO also brings the two worlds together by joining AI with human assistance. This ensures that calls are evaluated thoroughly and without any biases.

- Auto Detection: NEQQO detects non-compliance with its advanced technology and alerts the appropriate person about such issues. This helps prevent regulatory violations and promote compliance.

- Customizable Actions: This advanced platform provides users with various options to customize their dashboards to get the desired results. This includes customized alerts, flagging certain keywords, and reporting.

Conclusion

The complex regulatory landscape of insurance call centers needs effective compliance management to help maintain operational integrity. The insurance industry is governed by various regulations and standards; however, with advanced technologies like NEQQO, empowered supervisors, and the robust strategies mentioned above, insurance call centers can make sure their operations are consistent with the industry regulations. For sustainable growth and improved reputation, it is necessary that the insurance call centers implement effective compliance management practices.

—-

Amplifai. 2024. 80+ Customer Service Statistics You Need to Know in 2025. 2024 Amplifai, 2024.

Globenewswire. 2024. Survey: Only 16% of Organizations are Approaching the Next Frontier of Compliance. 2024 Globenewswire, 2024.

Enthu.ai. 2024. 51 Latest Call Center Statistics With Sources For 2025. 2024 Enthu.ai, 2024.